Opportunities, Bank Job Vacancies & Careers for Freshers

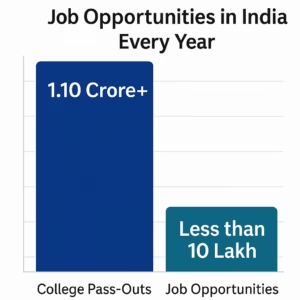

India’s graduate pipeline is growing faster than formal white-collar vacancies. With over 1.1 crore fresh graduates entering the job market this year, competition is fierce. In this scenario, a bank job stands out with steady hiring, clear growth paths, and attractive perks. Let’s dive into why bank jobs for freshers are so in demand and where the latest bank job vacancies lie.

India’s Graduate Pipeline vs. Formal White-Collar Vacancies

According to the All India Survey on Higher Education (AISHE), in 2021-22 India had 1.07 crore college pass-outs*, growing at 3–4% annually. This year, at least 1.1 crore+ freshers will enter the job market, competing not just amongst themselves but also against the backlog of candidates from the last few years, at least those who have been struggling to make it to a good organised sector job.

*“Pass-outs” reported by AISHE includes under-grad + post-grad + diploma

Key Takeaway: Aim for your preferred career for sure, but getting into any good career is the most important first step, regardless of whichever sector it is

Sector-Wise Estimated Hiring in FY 2025

| Sector | Estimated Hiring | Typical CTC (₹ LPA) |

| IT / ITeS & Digital Tech | ≈ 1.5 lakh | 3.5 – 6 |

| Banking & Insurance (BFSI) | ≈ 1.25 lakh | 3 – 5 |

| E-Commerce & Quick-Commerce | ≈ 60 k | 3 – 7 |

| GCCs & Analytics/Consulting | ≈ 30 k | 8 – 15 |

| Healthcare & Pharma (Corp.) | ≈ 60 k | 4 – 7 |

| Manufacturing & EV / Electronics | ≈ 40 k | 4 – 6 |

| Government & PSUs (non-bank) | ≈ 12 k | 5 – 7 |

| EdTech / Training Services | ≈ 10 k | 3 – 5 |

Key Takeaways:

- Only 5–10 lacs new white-collar jobs appear each year vs. 1 crore+ freshers.

- BFSI ranks amongst the top sectors in fresher hiring with ≈ 1.25 lakh seats.

- Layering industry-ready skills is crucial to beat the competition.

Which sector is better?

All sectors have their own upsides and downsides. Just as an example, we have summarised some broad pros and cons of some key sectors to give you a sense of how it looks:

IT/ ITeS & Digital Tech

- Pros: Faster salary jumps; Cutting-edge projects and skills

- Cons: Project-based uncertainty; Risk of layoffs; AI-driven disruption

Government

- Pros: Stable pay and allowances; Very high job security

- Cons: Low vacancies and heavy competition; Slow, time-bound promotions; Rigid structures and processes

E-Commerce & Quick-Commerce, EdTech

- Pros: Rapid growth and innovation; Plenty of entry-level roles

- Cons: High performance pressure; Weekend and irregular shifts common

Key Takeaway:

No matter which sector you pick—be it a bank job in BFSI or a tech role—India’s economy is set to keep growing. If you bring a strong work ethic and layer job-ready skills on top of your degree, you’ll build a rewarding career with steady growth and good pay.

Why a Bank Job Should Be Your Top Choice

Choosing a bank job offers many benefits:

- Booming Vacancies: Over 1.25 lakh (estimated) entry-level roles in 2025-2026.

- Attractive Pay & Perks: Fixed salary plus incentives; employee-friendly loan/FD rates.

- Clear Growth Path: Transparent promotions—leadership roles in 6–8 years.

- Rock-Solid Stability: Regulated by the RBI with zero layoffs historically.

- Local Posting: Most freshers work in their home district or nearby.

- Work-Life Balance: Generous public holidays.

- Social Respect: Especially in non-metro towns.

- Equal Opportunity: All graduates/post-graduates stand on the same starting line.

Key Takeaway:

A bank job combines security, respectable pay, and career clarity—ideal for freshers seeking stability and growth.

Overview of Banking Careers: Public vs. Private Sector

There are two main streams in Indian banking:

- Public Sector (PSU) Banks – Government-owned, recruited via IBPS or SBI exams.

- Private Sector Banks – Privately owned, hiring mostly through direct interviews.

Important Note: While the ownership may be different, every single bank in the country, whether public or private, are fully regulated by RBI. Right from getting a banking license, starting a new branch, and the basic policies, everything happens under the watchful eyes of RBI even in private sector banks.

PSU vs. Private Bank Job Comparison

The table below gives a quick view on how these 2 streams compare on key parameters that matter to you:

| Parameter | Private Sector Banks | PSU Banks |

| Popular Employers | HDFC, ICICI, Axis, Kotak | SBI, PNB, Bank of Baroda, Canara, Union |

| Recruitment Process | Direct interviews, sometimes aptitude tests | IBPS/SBI exams + interview |

| Eligibility – Education | Graduate (any stream) | Graduate (any stream) |

| Eligibility – Age | Freshers < 26–28: >28 can apply if they have proportionate & relevant work experience | 28–30 |

| Entry-Level Roles | Teller, Relationship Officer, Sales Officer, Assistant Manager etc. | Clerk, Probationary Officer (PO), Specialist Officer |

| Job Vacancies | ≈ 1 lakh | ≈ 20,000 |

| Starting Salary | ₹2.5 – 4.5 LPA (over 6 LPA for reputed MBA college-graduates) | ₹3 – 8 LPA |

| Annual Growth | Faster for above average performers | Slower, time-bound |

| Bonuses/Incentives | Performance-linked, in some cases ESOPs too | Low benefits |

| Work Pressure | Higher sales pressure, low operational work pressure | High ops pressure + rising sales targets |

| Career Growth | Fast for above average performers | Slower; based more on seniority |

| Job Security | Adequate for average performers; High for good performers | Very high |

| Transfers | Mostly within home state | Pan-India (rural/remote possible) |

| Retirement Benefits | PF, Gratuity, Pension in some cases | PF, Gratuity, Pension |

Key Takeaway:

Private sector banks offer quicker entry and faster growth; PSU banks provide stronger job security but slower promotions.

How to Navigate Bank Job Vacancies: Suggested Action Plan

As you might already know, I started my career as a Probationary Officer in the State Bank group, worked there for almost 9 years & then moved to HDFC Bank, where I worked for another 18+ years. In my own personal experience, a private sector banking career is a better choice for 4 key reasons:

- You will get a job fast

- You will grow faster

- You will make more money in your career

- You will get better job satisfaction

But frankly, different people may argue differently. At the end of the day, both are wonderful options & regardless of what you choose, you are certain to have a great career ahead.

Considering both options, here is our recommendation for what you should do:

Step 1: Target Private Sector Banks First

Why?

- Higher Vacancies: ~1 lakh vs. ~25 k in PSUs.

- Lower Competition: Fewer applicants than government exams.

- Quick Turnaround: 1–3 months of prep for starting a job (versus 2-4 years for PSUs)

Note: Steps 2-4 are relevant only if you want to proceed further from a private sector bank job to a PSU bank job

Step 2: Prep for PSU Exams in Parallel

- Allow 2–4 years to clear IBPS/SBI cycles.

- Continuous Learning: Keep updating exam patterns and syllabus (You may also refer BankersAdda)

Step 3: Leverage Private Bank Experience

- On-job Learning: Build skills while awaiting PSU results.

- Interview Edge: Real-world experience impresses selection panels.

- Make some extra money and build more self-confidence, both of which will not happen if you sit at home preparing for the PSU bank exams

Step 4: Make Informed Career Choices

- If PSU privatisation happens, private sector exposure becomes an asset.

- Few years in the private sector bank will help you decide whether you would like to continue there only or move to PSU banks.

- PSU banks are also currently doing lateral hiring of experienced bankers directly

Key Takeaway:

Starting with a private bank job accelerates your career, keeps you financially independent, and primes you for future bank job vacancies in both sectors.

How to prepare for a private sector bank role?

The key to effective bank job preparation for private sector roles – including the interview – is to become truly job-ready. A typical bank evaluates over a hundred aspirants before hiring a bank officer. Many are declined without even a second glance, while at least 10-20 aspirants may be seriously evaluated, before 1 is shortlisted. But how do you make sure you are job-ready and you are the one selected?

We have prepared a full guide for this which you can access by clicking here.

A quick summary from that article:

- Improve your communication skills, along with basic functional fluency in English language

- Improve your foundational skills in numerical ability, data handling and basic technology tools

- Learn banking domain knowledge – potentially big USP

- Behavioural readiness & professional etiquette

- Career clarity

How BygC Accelerates Your Journey

- Banking course with assured placement support: 6-weeks only & fees that you can make up with 1 month’s salary

- 3-Day Banking Bootcamp: Fastest program with 3 assured interview opportunities

🔚 Wrap-Up & Next Steps

India’s graduate pool outstrips formal white-collar vacancies. The winners are those who combine their degree with industry-ready skills and stay agile. A bank job opens doors to a stable banking career, with a clear ladder to grow, earn well and lead a good life.

Ready to kick-start your bank-job dream?

👉 Or click here to WhatsApp us directly for a free counselling session

Author:

Srikumar Nair

Co-founder & CEO – BygC

Bio: Author has worked with the 2 premier banks of the country – SBI & HDFC Bank for over 26 years. He has handled large zones in HDFC Bank with over thousand employees in his team. He is a PGDGM from NMIMS, Mumbai. He also writes on LinkedIn.